After several years of procrastination, I recently tried getting onto Intuit’s Mint app to track my income and expenses. However, I realized that Mint shut down its service earlier this year and had to find an alternative. Monarch Money featured prominently during my search, so I had to sign up and try it.

From the onset, I could tell Monarch was designed to cater to a wide range of users with varying financial situations and personal goals. Its simple design makes it easy for anyone to work with, whether you’re a beginner in financial planning or a finance professional.

Navigating the onboarding process was a breeze, and I was pleased to find an option that lets you collaborate with a partner, friends or family to track your budgets and finances under one plan.

Over the past few weeks, Monarch has been my companion in my bid to be financially disciplined. It’s already helped me develop a working financial plan for the next few years, as well as a retirement plan. My wake-up call was when I saw this research by the Employee Benefit Research Institute. It states that 61% of Americans feel stressed about preparing for retirement. I realized I’m part of this group, primarily because I don’t have a concrete retirement plan.

What Are Monarch Money’s Main Features And Benefits?

Monarch provides a complete picture of your financial health by combining personal and collaborative budgeting tools and investment tracking and unifying all your bank accounts under a single platform. Here are some of the features that make this possible.

User-Friendly Interface

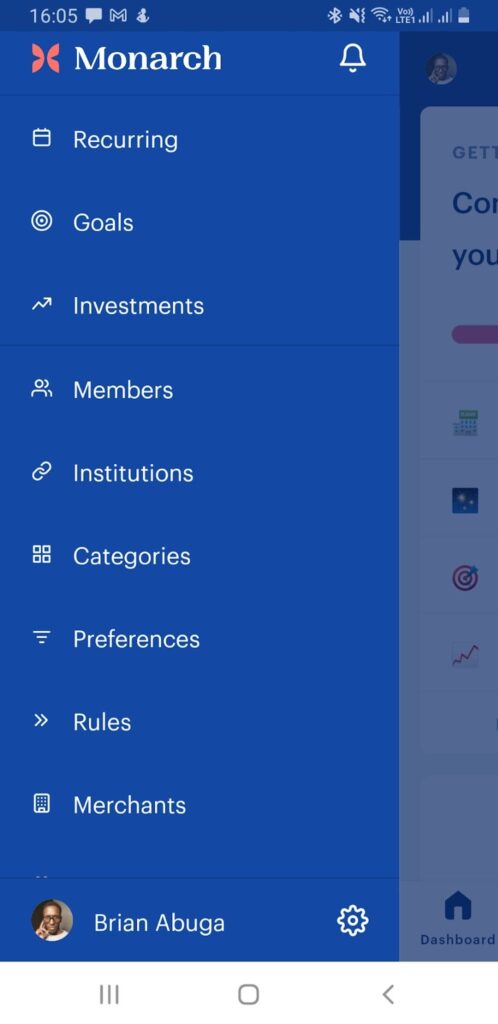

One of the things I’ve come to appreciate about working with Monarch is how easy it is to use. The intuitive interface offers so much without feeling too cluttered or complicated, whether using the web or mobile app.

Onboarding is easy, with visual aids guiding you through setting up your account for the first time. If you were a Mint user before, Monarch will prompt you to move your data over and provide instructions on how to do so smoothly.

You can immediately link all your existing bank accounts or create manual accounts. Once your accounts are ready, you can credit or debit each accordingly so the Monarch app can track your spending, recurring expenses and investments and generate relevant reports.

Because Monarch is a paid app, it’s 100% ad-free, unlike most free alternative budgeting apps. An ad-free user interface reduces clutter and distractions when breaking down transactions and financial reports.

Comprehensive Financial Overview

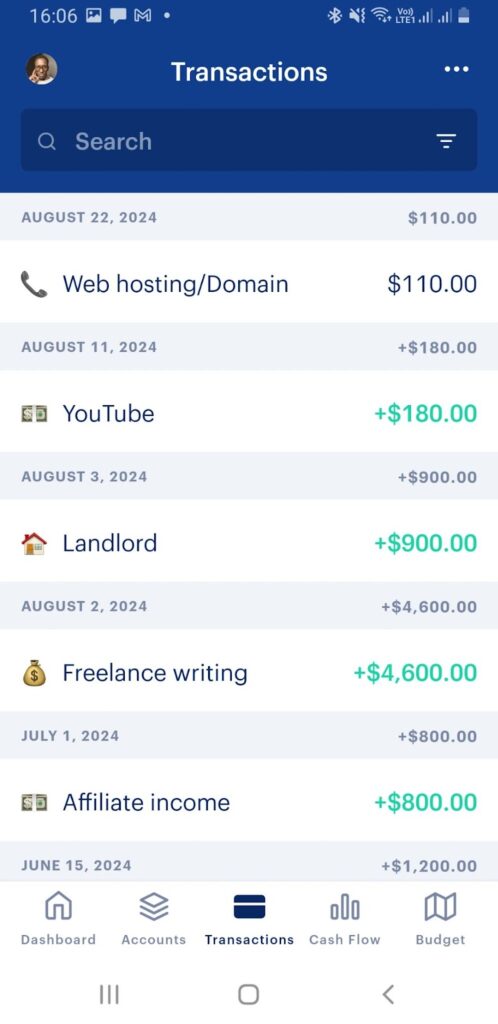

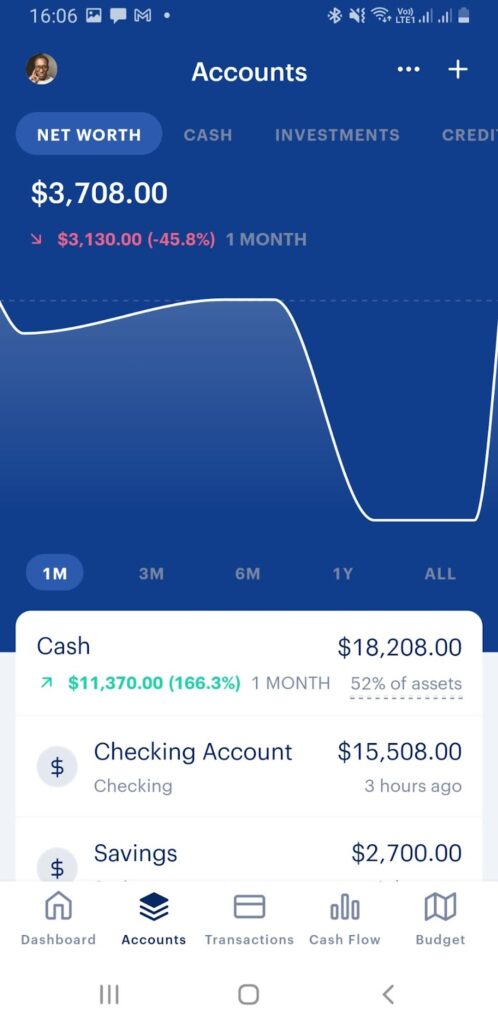

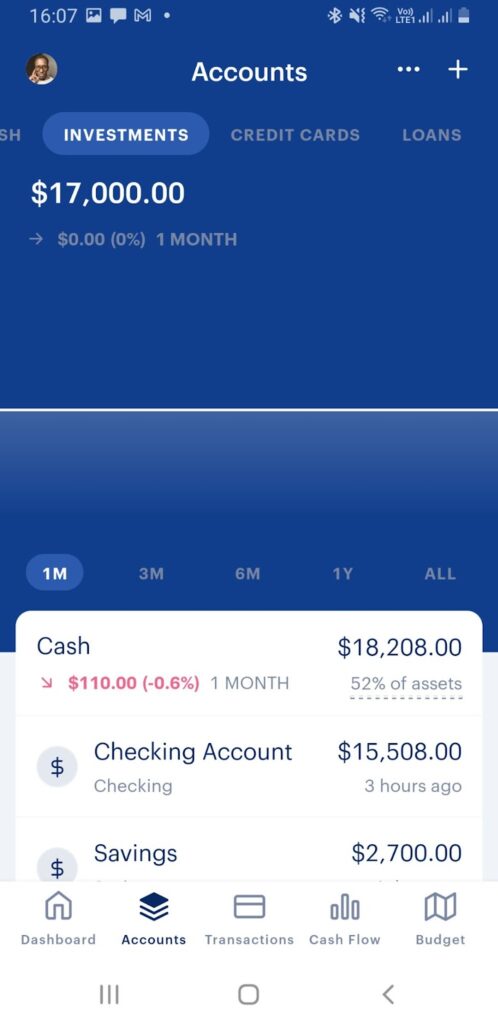

Monarch primarily aggregates all your financial transactions and accounts in one place for centralized monitoring. You can connect your checking accounts, savings accounts, mortgages, credit cards, etc., for real-time tracking, so you don’t have to enter your everyday transactions manually.

You can access a quick overview of your general financial health from this aggregation by going to the accounts section on Monarch. Here, the app will give you information such as your overall net worth, debt, total investment amount and how much cash you have on you at a given time.

This information will update in real time with each transaction in any of your accounts, whether automatic or manual.

Having such a holistic financial picture in one place has many benefits regarding your money, life and legacy. You’ll not only be in a better position to improve your financial planning in the years to come but also be able to manage your debt and risks diligently.

Conspicuously missing from all the benefits is the ability to keep track of your credit score on Monarch. This is a standard feature on many personal financial management tools, but for some reason, they chose to exclude it despite the relatively hefty subscription fee. However, it may not be essential, as you can always monitor your credit score elsewhere.

Goal Setting And Tracking

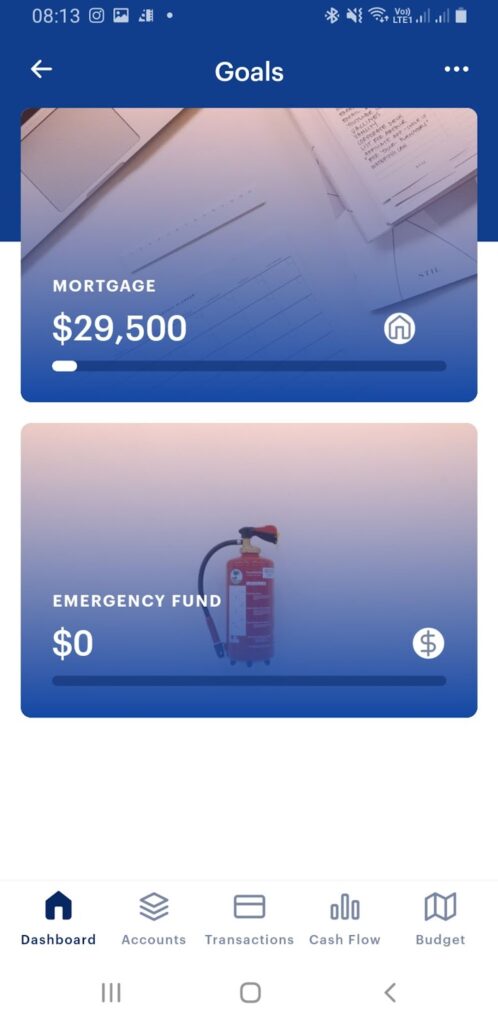

Monarch comes with a dedicated goal-setting section. Here, you can select one or multiple goal options, rename them and add an optional image. Once complete, set the amount you want to work toward and assign the accounts from which to meet these targets. You can link a particular goal to more than one account.

You can set goals for saving up for something specific, like paying down your mortgage, setting up an emergency fund or crafting an investment plan. The app will automatically track and update your progress as soon as any transaction happens. You can also set shared goals with a partner in one household.

Your progress will be presented visually, with each transaction pushing you closer to your goal. This visual representation may seem simple, but it goes a long way in encouraging you to keep working toward your set financial goals—it’s like an addictive game.

Personalized Insights And Advice

Monarch shines in this department by monitoring how you interact with your money in various accounts, even in the smallest transactions. It then collates this information with your financial goals and advises you accordingly. The endgame ensures you are as frugal and efficient as possible in achieving your goals.

For example, if your emergency fund is below par, Monarch will advise you to inject funds, cut funds from elsewhere, or allocate more to bring the figure up to the recommended level. The app might also suggest having a more diverse investment portfolio if you have little or nothing to show in your accounts.

Monarch doesn’t focus on budgeting alone—it’s meant to provide users with an overview of their financial health and offers personalized advice to improve it. With advice tailored to each specific user’s unique needs, it’s bound to foster better financial habits. People are different and approach life differently, which means no blanket advice can cater to all. Monarch addresses this by personalizing its recommendations based on each user’s habits.

Budgeting Made Simple

All Monarch transactions linked to a financial institution or merchant happen in real time. This means you’ll always have an accurate picture of your finances at any given time. Planning your budget will be easier with all your financial information at your fingertips.

You can simplify budgeting by categorizing each account or transaction into specific preset categories. Examples of these categories on Monarch include investments, cash, loans, and credit cards to separate your accounts.

For transactions, categories include income, expenses and transfers, which are further broken down into specifics like paychecks, housing and credit card payments, respectively. Note that you can always customize the preset categories by deleting, editing or adding your own.

Monarch budgeting gets even better if you consider how it visualizes spending, income and debt patterns. You can easily determine your financial health without any special analysis.

Effective budgeting is the first step toward achieving financial discipline. Monarch helps by managing or eliminating debt, ensuring secure savings and directing your financial resources to the right place. Effective budgeting can help you achieve financial stability, accumulate wealth and gain financial freedom.

Security And Privacy

Given that Monarch has access to sensitive user financial information, the company employs bank-level encryption to secure it. When accessing your accounts, Monarch doesn’t store your login credentials to ensure your bank account isn’t exposed at any point. Multifactor authentication is available to keep bad players out of your account when you log into the app.

Trust between a service provider and its users is critical if both parties are to benefit. For this reason, any company handling any customer or user info should employ the strictest security measures to foster trust between the two parties. Monarch does this well and has transparently outlined how it uses customer data on its privacy policy page.

Community And Support

Monarch has a dedicated help page on its website where you can navigate to articles that may answer your queries. You can also contact Monarch directly by filling out an email form on the help page—they’re highly responsive. I’ve also found the Monarch Money subreddit helpful, as you can pose a problem, and another Monarch user can help you based on their personal experience.

In my short time with the app, I’ve been able to solve a few challenges within minutes by simply visiting the subreddit. It’s a vibrant community of Monarch users who are always willing to help and discuss how the app can be improved. With the surety of always finding a solution there, there’s some incentive to keep using the app.

Monarch Money Pros And Cons

| Pros | Cons |

| Easy to use | Price |

| No advertisements | Credit score tracking is unavailable |

| Collaborates with friends and family | |

| Advanced financial management features | |

| Customer care |

How Much Does Monarch Money Cost?

Mint, the king of budgeting apps before its dissolution, was free. Monarch, being the next best alternative, is quite pricey. To get started, you’ll have to pay $14.99 monthly or $99.99 per year if you choose the annual plan (around 40% cheaper).

There’s a seven-day free trial on sign-up, which you can take advantage of before committing. You can also refer others to receive subscription credits to extend your subscription.

Keep Your Finances In Check With Monarch Money

Monarch Money has stood out as a worthy Mint alternative since the latter closed shop. Despite being a paid service, unlike Mint, this app could be worth every penny if you utilize its features fully. Its ability to give you a holistic view of managing your money can be life-changing if you deliberate and decide to budget according to the app’s advice.

You can set your financial plans in order and reduce stress, knowing everything is on track and predictable. Once your finances are in good shape, you’ll be free to take control of other aspects of your life besides money. In my short time tinkering with Monarch, I’ve been able to keep track of every penny and have devised a plan to reduce my debt to manageable levels.

Frequently Asked Questions (FAQs)

Is there a free version of Monarch Money?

No, Monarch Money does not offer a free plan beyond its seven-day free trial.

Does Monarch Money have credit score tracking?

No. You cannot track your credit score on Monarch.

Is Monarch Money available on iPhone?

Yes. Monarch Money offers iOS and Android apps for financial tracking on the go.

Can I sync my bank account with Monarch Money?

Yes. As long as you’re in the United States or Canada.

Photo by PeopleImages.com – Yuri A/Shutterstock.com