I am a spender.

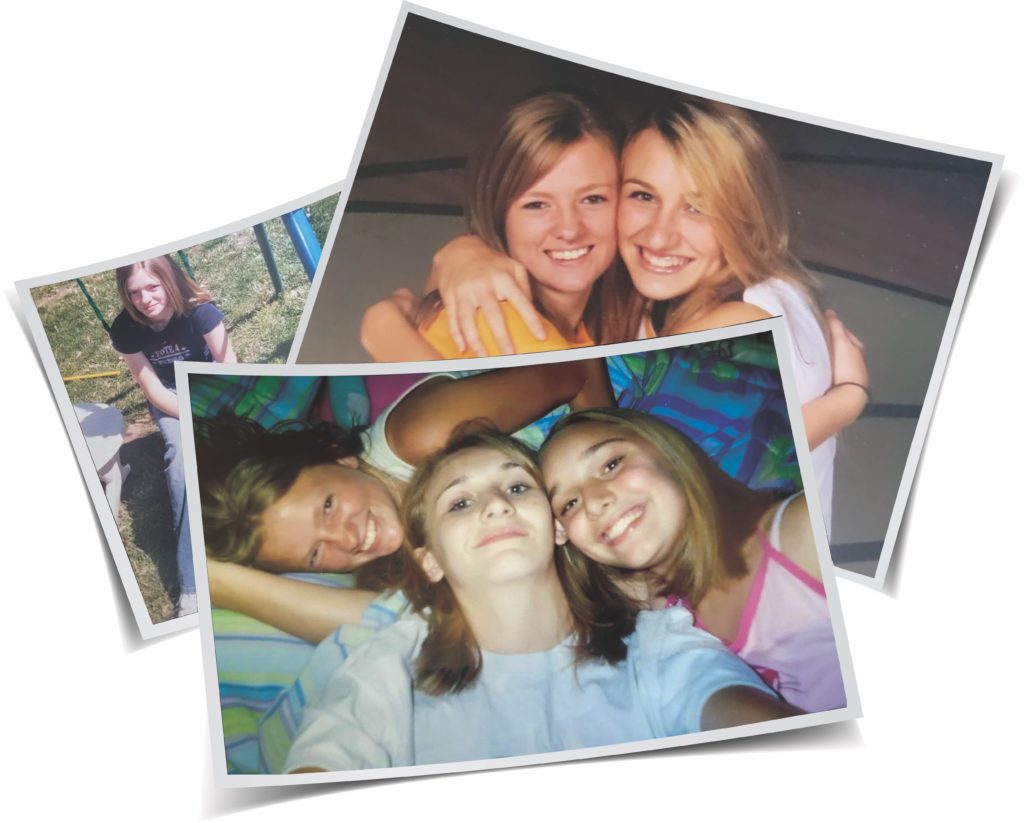

At 13, I roamed the aisles of Target with my best friend, Mandi, calculating the best ways to spend every penny of the $20 bill in my lime green Gap purse: One box of Nutty Bars, a pink-and-white swimsuit speckled with ice cream cones, and a two-pack of Lip Smackers. Money gave me a sense of power and control I hadn’t yet known. It opened a world of possibilities that a “you can pick out one item from the toy aisle” just couldn’t provide. Let’s just say I didn’t keep $20 bills lying around long.

My sweet tooth spending habits haven’t changed much (current favorite: Nerd Rope Bites), but I have since employed some boundaries and goals around spending that don’t result in as many swimsuits but do leave me feeling empowered and hopeful about my financial future.

As a woman, this, the Money Issue, is special to me. I grew up regurgitating jokes about marrying rich or winning the lottery. My circle of friends never really joked about becoming proficient with investments or joining the C-suites to make our own fortunes. My dream is to open an accessible (read: not prohibitively expensive) writer’s retreat in southern Portugal that doubles as a cat sanctuary. I won’t be able to do it without money, and I plan to get there, dollar by dollar, in a way that feels right for me. It’s a beautiful thing to be in a committed relationship with someone who has the means to support both of you—and maybe a family, too. It’s also a beautiful thing to forgo those options in search of self-sufficiency and career mastery.

Who better to be the face of those ideals than Sophia Bush and Nia Batts, advisers for First Women’s Bank, an organization built, founded and actively managed by women? I hope you like this issue as much as we loved putting it together. In it, you’ll hear from Pamela Zapata and her mission of pay equality for BIPOC entrepreneurs. Evelyn Castle shares her story of investing with impact by providing real capital to organizations throughout Africa. Five financial experts give the lowdown on best practices for your money in 2023. You’ll read the inspiring story of Daron Babcock, successful corporate executive-turned-sustainable farmer—who has spent his latter years helping formerly convicted persons grow their own food and rewrite their own futures.

I think money is neutral—an inanimate object like any other. But with it, you can open doors for people who may not have access to their own set of keys yet. You can create financial security for yourself, and then turn to help make the world a better place than when you found it—through a bank, through a retreat, through a book, through your words in your community. To me, that’s the power of money well used, of a life well lived.

Thoughts on the new issue or anything you see inside it? Reach me by contacting [email protected].

This article originally appeared in the November/December 2022 issue of SUCCESS magazine. Photos courtesy Cecilia Meis