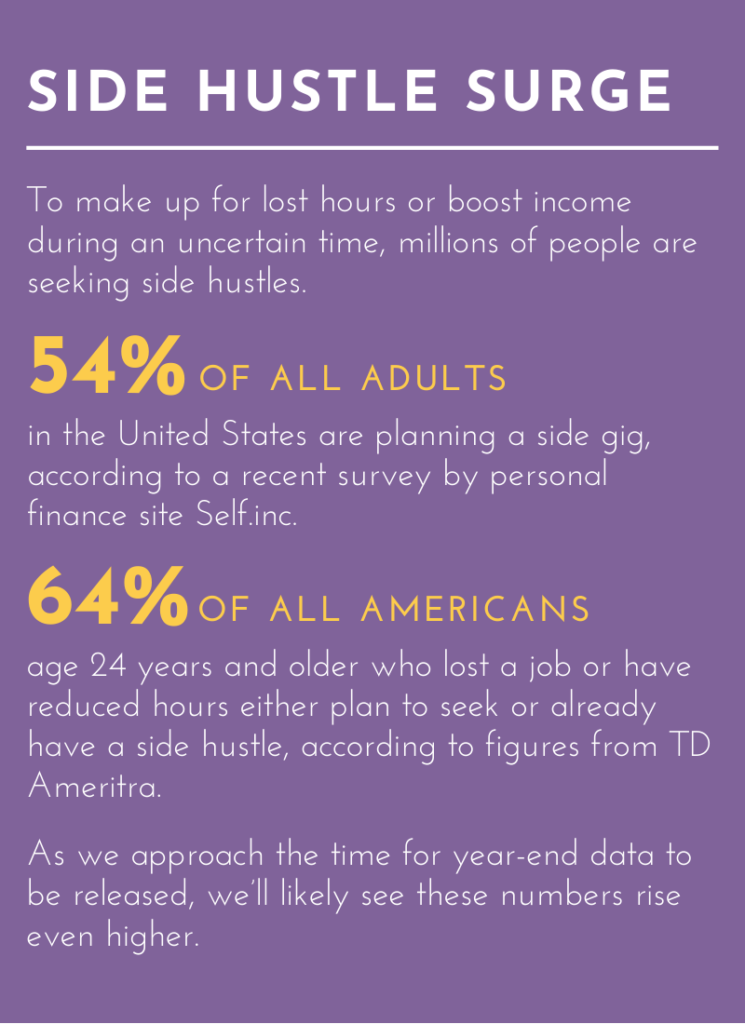

Balancing side hustles can feel like skipping rope sometimes—you’re always on your toes. But with millions of people out of work or accepting reduced hours at their full-time jobs, the side hustle has become more important than ever.

Since one side hustle might not be enough to meet your big goals, you’re probably feeling stressed and pushed to the limit some days. How do you handle more than one side gig and still take care of your well-being?

The answer to this question is going to differ depending on the type of side hustle you’re working, but in general there are some ways you can manage your multiple streams of income and still maintain your sanity.

1. Create a central organizational hub.

Whether it’s on paper, in your laptop, or in an app, a central place to track hours, commitments and deadlines is imperative to keep you organized. Apps like Asana and Basecamp can track projects and deadlines, while Toggl and aTimeLogger help you track your hours spent working. If you’re more hands-on, set your schedule and log projects in a paper planner. Save notes in a folder or in an app like Evernote, which can store photos and links as well as text notes. Keeping all your dates, times, and responsibilities in one place will help you feel more in control of your schedule.

2. Dedicate a workspace.

Even if your side hustles take you out of the house most of the time, having a place where you can sit down, review your calendar, and keep track of things like receipts, taxes, and communications can really help you feel supported. Dedicate one place in your home as your workspace, and then ask others in your household to respect your boundary. Keep all your pertinent papers, files or notes in your workspace to stay organized.

3. Block off time for you.

Since you’re the one in charge of how much work you accept, why not set your own days off? Even if you split time off over a few afternoons rather than two full days in a row, having those times to refresh and rest are vital to your sanity and the health of your relationships. Be sure to block them off of your calendar and commit to yourself to uphold them, so you don’t accept work during your downtime.

4. Defend your priorities.

Just as you block off time for your family and yourself, you also need to block off time for work. Let people know your working hours, and really focus while you’re on the job. When you don’t have one primary, full-time job, people can look at what you do and see it as less important. This leads to interruptions. Show by example that your work is serious by taking it seriously and setting down the phone during work or closing the door to your workspace.

5. Try outsourcing.

If you’re running your own knowledge sharing or creative service business on the side, consider outsourcing administrative or communication tasks. Answering emails, sending invoices, and uploading documents can all be done by someone without much knowledge of your business. You can create email templates they can use or record video instructions for a project where you want more in-depth help. Delegating and outsourcing are vital to growing your business, so start early and set a productive habit.

6. Look for passive income opportunities.

To really maximize your return, invest your time up front in a side hustle that can give you passive income down the line, such as direct selling, affiliate marketing, or real estate investments. While these ventures may not pay loads at the beginning, you could be setting yourself up for a steady stream of additional income later on.

7. Stay encouraging.

When you’re juggling a lot, it can be easy to slip into a negative attitude or even subject yourself to negative self-talk. Rather than berating yourself for not getting enough done, focus on how you can get help, get organized, and stay focused. To do those things, you’ll benefit from some encouraging self-talk and a little understanding.

If you’re only considering a side hustle at this point, all of this may sound like a lot to manage. But think of this like you would your day job: Your priorities, workload and schedule there have probably shifted countless times over your career.

Change is as inherent to a side hustle as it is to a straight gig. You’ve got to learn to deal with it—and odds are, you will, especially if you stick to the above rules.

The big difference? In a side hustle, you’re in charge.

Ask The SideHustler

Q: I hear the term “passive income” a lot, but it seems to mean different things to different people. Can you explain?

A: Passive income requires little to no effort to maintain. Most passive income opportunities do require some financial or time investment up front to establish them, but once they’re going, they can be self-sustaining. When evaluating a passive income source, consider your interest level and required up-front investment. Here are a few of the most reliable passive income opportunities:

Direct selling – With a variety of products and services to choose from, the direct selling industry has something to offer just about anyone. Direct selling companies offer stability, mentorship and back office logistics to the small business owner who wants to join an existing organization on his or her own terms. Over time, one business owner can gain enough clients with repeating orders to generate a nice passive income stream.

Real estate investments – Whether you start by renting a room in your home or find a rental opportunity, real estate is a market that provides solid passive income. A tried and true way to start is to find a rental you can live in first, and then move out when you’re able to buy a second property, renting the first one to someone else. The rent will cover the home’s expenses, as well as provide you with passive income. Your involvement can be minimal if you hire a management company to deal with day -to -day issues.

Dividend stocks – When you invest in the stock of a specific company, you become a shareholder and are entitled to payment at regular intervals from the company. The more shares you own, the higher the payout. Of course, most people hold these funds for long periods of time, as day trading (trading stocks based on daily fluctuations in the market) is quite risky. In the case of stocks, your return on investment would be long-term rather than a quick turnaround. In addition, as we’ve all seen recently, the stock market is a gamble when the economy takes a dive.

Affiliate marketing – Ready to sell someone else’s product on your website? Affiliate marketing lets you gain a small profit from the sale of products you promote on your blog, website, or social media profile. You simply place an ad on your page or write a post that advertises the product and provide a link to it on Amazon, eBay, or other marketplace. Then when people click the link and purchase, you get a small percentage of the purchase price. With the right search engine optimization, your affiliate page could bring you a nice passive income to supplement other endeavors.

Financial strategies – If you’re looking for a low-effort, safe passive income opportunity, check out online banking for high yield savings accounts or CDs that offer above-average interest rates. You could also invest in a bond ladder, which is a series of bonds that mature in a sequence over time. These strategies aren’t flashy, but they are safe and only require a little research and the initial funds.

Whatever passive income strategy you choose, keep in mind that you may have to invest some sweat equity up front to really build it on the back. But the automatic deposits in your future could be well worth it.

Read next: 4 Reasons Why You Haven’t Started Your Side Hustle

This article originally appeared in the November/December 2020 issue of SUCCESS magazine.

Photo by DimaBerlin/Shutterstock.com